In recent years, a noticeable shift has taken place in the investment behavior of young Pakistanis. Instead of putting their money into the unpredictable stock market, many are now turning to real estate. This trend isn’t just a coincidence—it’s a result of practical thinking, long-term planning, and the growing appeal of property ownership.

Why Young Pakistanis Prefer Real Estate

Young investors in Pakistan are more informed than ever. Thanks to the internet and social media, they have access to a wealth of information. Still, many prefer real estate over stocks for one big reason: stability.

Also Read: Belarus Launches E-Visa for 67 Countries

The stock market, while potentially profitable, is highly volatile. A single piece of news can cause prices to rise or fall instantly. On the other hand, real estate tends to offer steady and predictable returns. This peace of mind is crucial for young people starting their financial journey.

Moreover, real estate is tangible. Unlike stocks that exist on a screen, a piece of land or a house is something you can see and touch. For many, this physical ownership feels more secure.

Real Estate vs. Stock Market Investment in Pakistan

Let’s compare the two in simple terms.

1. Risk Level

Stock investments in Pakistan often face sudden ups and downs. Political changes, economic news, and international events can all impact the market. Real estate, however, is generally less risky. Property values might not rise quickly, but they rarely crash overnight.

2. Returns Over Time

While the stock market can deliver quick profits, real estate offers long-term growth. Properties usually appreciate steadily over the years. In addition, investors can earn rental income, which adds to the total return.

3. Inflation Protection

Real estate acts as a natural hedge against inflation. As the cost of living rises, property values and rental income often increase too. Stocks can lose value during inflationary periods, especially if companies struggle with rising costs.

4. Financing Options

It’s easier to leverage real estate than stocks. In Pakistan, many developers now offer installment plans and affordable booking options. For instance, Lakeshore City, nestled amid majestic mountains with a stunning dam view, offers an easy 60-month installment plan, making it perfect for first-time investors.

Long-Term Benefits of Real Estate Investment in Pakistan

Real estate in Pakistan offers many benefits, especially for younger investors:

1. Wealth Building

Over time, property values tend to rise. Buying early allows investors to build wealth gradually.

2. Passive Income

Rental properties provide monthly income without the need to sell. This can be a reliable cash flow source for young investors.

3. Security for the Future

Real estate can be used as collateral for loans, making it a strong financial tool.

4. Legacy

Unlike stocks, property can be passed down to future generations, helping to secure long-term family wealth.

How to Start Investing in Real Estate in Pakistan

Many young people feel real estate is out of reach. But that’s changing fast. Here’s how to start:

1. Set a Budget

Start small. You don’t need millions to begin. Some projects, like Lakeshore City, allow you to book a 5-marla plot for just 25,000 PKR. This amount even counts as your first installment—with no down payment and no confirmation charges.

2. Choose the Right Project

Look for reliable developers. A good location, future potential, and legal clarity matter. Lakeshore City offers plots, commercial spaces, and farmhouses with scenic views and natural beauty.

3. Understand the Payment Plan

Check if there are hidden fees or large upfront costs. A smooth installment plan, like the 60-month plan at Lakeshore, makes it easier to manage your finances.

4. Check Documentation

Make sure the property is legally approved. This avoids trouble later.

5. Think Long-Term

Real estate isn’t a get-rich-quick game. It’s about steady growth and future returns. Be patient, and your investment will likely grow.

Advantages of Property Investment for Young Pakistanis

Young people in Pakistan are smart and ambitious. Real estate matches their mindset and goals. Here’s why:

- Low Entry Cost: New projects offer affordable booking options.

- Easy Plans: Flexible payment options make it possible to invest while still managing other expenses.

- Future Growth: Cities are expanding, and land prices are rising.

- Peace of Mind: Real estate offers less stress compared to watching stock prices daily.

- Emotional Satisfaction: Owning a piece of land feels rewarding. It’s a symbol of success.

Why Choose Lakeshore City?

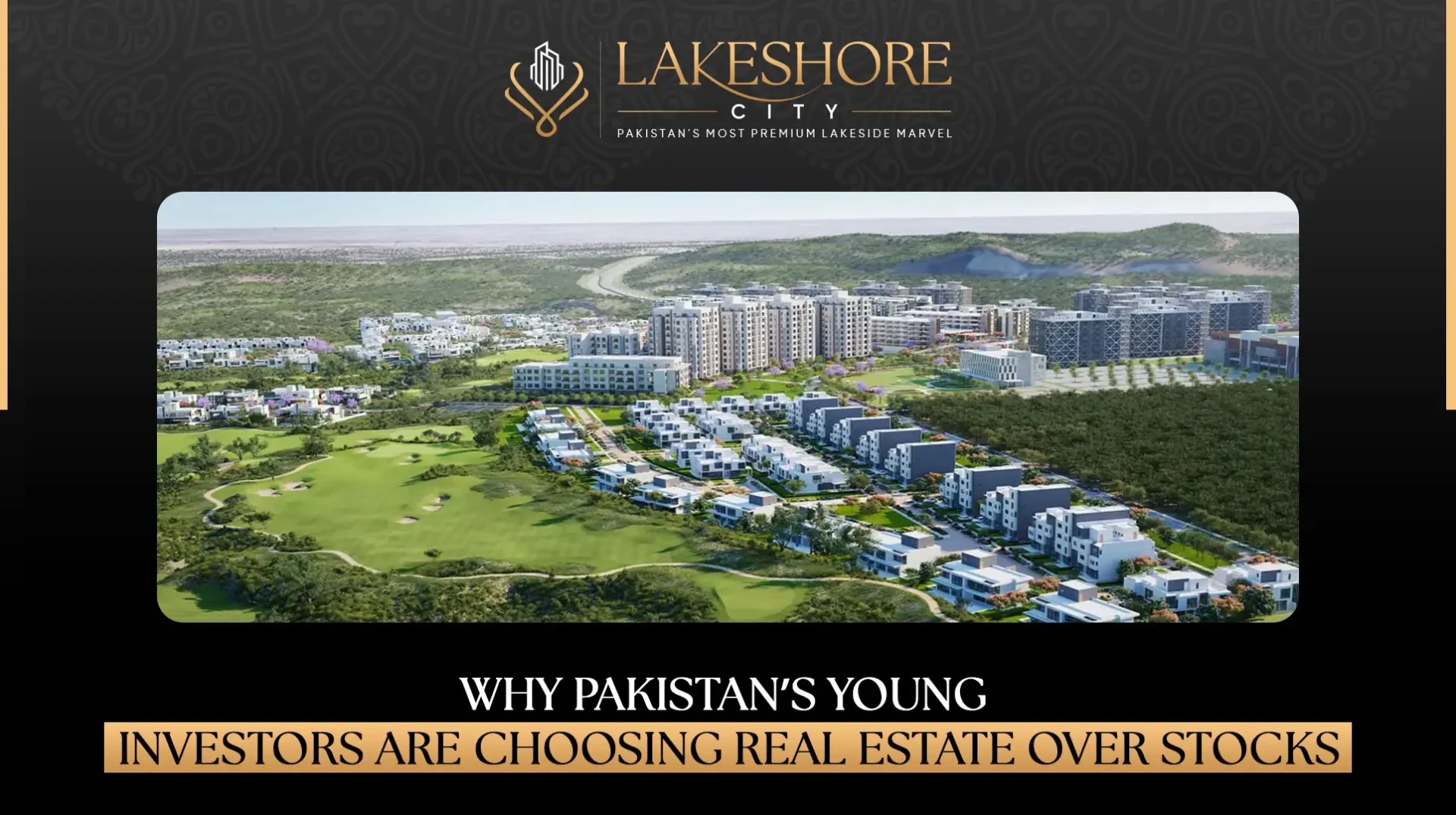

Lakeshore City is more than just a housing project. It’s a lifestyle.

- Breathtaking Location: Surrounded by mountains with a beautiful dam view.

- No Hidden Charges: No down payment, no confirmation fees.

- Flexible Plans: Book your plot in just 25,000 PKR, which is also your first installment.

- Diverse Options: Choose from Lakeshore Residencia, Commercial, or Farms.

- Secure Investment: Peaceful environment with future value growth.

Whether you want to live, rent, or just invest, you do not need a hefty amount. Hence, Lakeshore City is the smart choice for Pakistan’s young investors.

FAQs

1. Why do young Pakistanis prefer real estate?

Because it offers long-term security, stable returns, and is less risky than stocks.

2. How can I start investing in real estate in Pakistan?

Choose a reliable project, check documents, and start with an affordable installment plan.

3. Is real estate a good long-term investment?

Yes, property usually appreciates over time and can provide rental income too.

4. Why is Lakeshore City a good choice?

It offers no down payment, no confirmation charges, and a beautiful location.

5. What’s the booking price for a 5-marla plot in Lakeshore City?

Just 25,000 PKR, which is also your first installment.

6. Can I invest while still managing other expenses?

Absolutely. Lakeshore’s easy 60-month payment plan makes it manageable for young investors.

Read More:

How to Build a Commercial Empire by Investing in the Right Locations

The Role of Modern Infrastructure in Attracting Business Investments